Traveling by air is undoubtedly one of the quickest and most convenient ways to get to your destination. With American Airlines being one of the most popular airlines in the US, it’s no wonder that many people choose to book their flights with them. However, with the uncertainty of travel, the question of flight insurance often arises. In this article, we’ll take a closer look at how much flight insurance costs for American Airlines and what it covers. Keep reading to ensure you have all the information you need for a worry-free travel experience.

Contents

- How Much is Flight Insurance for American Airlines?

- Frequently Asked Questions

- What is flight insurance?

- Does American Airlines offer flight insurance?

- How much does American Airlines flight insurance cost?

- Is it mandatory to purchase flight insurance when booking a ticket with American Airlines?

- How can I purchase flight insurance for my American Airlines flight?

- Travel Insurance Tips: 7 Things to Know Before You Buy

- How To Print A Boarding Pass For United Airlines?

- Are American Airline Tickets Cheaper At The Airport?

- How To Sign Up For American Airlines Frequent Flyer?

How Much is Flight Insurance for American Airlines?

If you’re planning a trip on American Airlines, it’s important to consider purchasing flight insurance. This type of insurance can offer peace of mind and financial protection in case of unexpected events such as trip cancellations or delays, lost luggage, or medical emergencies during your travels. But just how much can you expect to pay for flight insurance when flying with American Airlines? Let’s take a closer look.

Factors Affecting Flight Insurance Pricing

The cost of flight insurance can vary depending on a range of factors, such as the length of your trip, your destination, your age, the number of travelers in your party, and the level of coverage you need. In general, the longer and more complex your trip, the higher the cost of insurance is likely to be. Additionally, the more coverage you require, the more expensive your policy will be.

To get a sense of the cost of flight insurance for American Airlines specifically, you’ll need to get a quote from a reputable insurance provider. Some popular options include Allianz Travel, Travel Guard, and InsureMyTrip. Be sure to compare quotes from multiple providers to find the best deal for your needs.

Types of Flight Insurance Offered by American Airlines

American Airlines offers several types of flight insurance that you can purchase either during the booking process or separately. These include:

- Trip Cancellation Insurance: This type of insurance can provide reimbursement for non-refundable expenses if you need to cancel your trip for a covered reason, such as illness, injury, or severe weather.

- Trip Interruption Insurance: Similar to trip cancellation insurance, trip interruption insurance can cover expenses if your trip is cut short for a covered reason.

- Baggage Insurance: This type of insurance can offer reimbursement for lost, stolen, or damaged luggage during your trip.

- Medical Insurance: Medical insurance can provide coverage for emergency medical expenses while you’re traveling, including hospital stays, doctor visits, and prescription medications.

- Accidental Death and Dismemberment Insurance: This type of insurance can offer financial protection in case of a serious injury or death during your trip.

Benefits of Flight Insurance

While flight insurance may seem like an unnecessary expense, it can provide several important benefits for travelers. Some of the key benefits of flight insurance include:

- Peace of Mind: Knowing that you’re protected against unexpected events can help you relax and enjoy your trip without worrying about what might happen.

- Financial Protection: Flight insurance can provide reimbursement for non-refundable expenses and other costs related to unexpected events, potentially saving you hundreds or thousands of dollars.

- Emergency Assistance: Many flight insurance policies include access to 24/7 emergency assistance services, which can be invaluable if you find yourself in a difficult situation while traveling.

Flight Insurance vs. Travel Insurance

It’s worth noting that flight insurance is just one type of travel insurance that you may want to consider. Other types of travel insurance can provide additional coverage for things like trip cancellation or interruption, medical emergencies, and rental car damage. While flight insurance can be a good option if you’re looking for basic coverage during your flight, it may not be enough protection if you’re taking a longer or more complex trip.

The Bottom Line

So, how much should you expect to pay for flight insurance when flying with American Airlines? The answer will depend on a range of factors, including your travel plans and the level of coverage you need. To get a sense of the cost of insurance for your specific trip, be sure to compare quotes from multiple providers. And remember, while flight insurance can be a worthwhile investment for some travelers, it’s important to carefully consider your needs and budget before making a decision.

Frequently Asked Questions

What is flight insurance?

Flight insurance is a type of travel insurance that provides financial protection in case of travel-related mishaps such as flight cancellations, delays, lost luggage, and medical emergencies.

It is designed to help travelers avoid financial losses that may arise due to unforeseen circumstances that may impact their travel plans.

Does American Airlines offer flight insurance?

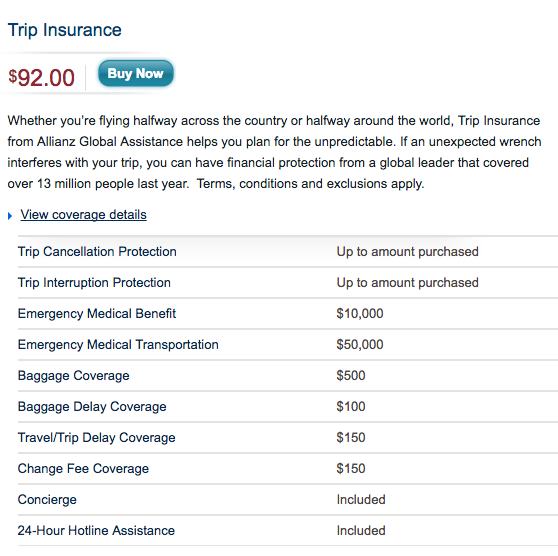

Yes, American Airlines offers flight insurance through its partnership with Allianz Global Assistance.

The insurance covers a range of travel-related incidents such as trip cancellations, travel delays, medical emergencies, lost or stolen baggage, and more.

How much does American Airlines flight insurance cost?

The cost of American Airlines flight insurance varies based on several factors such as the length of the trip, the age of the traveler, and the level of coverage required.

However, a basic travel insurance plan for a domestic trip can cost as little as $24 while a comprehensive plan for an international trip can cost upwards of $200.

Is it mandatory to purchase flight insurance when booking a ticket with American Airlines?

No, it is not mandatory to purchase flight insurance when booking a ticket with American Airlines.

However, it is recommended that travelers consider purchasing travel insurance to protect themselves against unforeseen incidents that may disrupt their travel plans.

How can I purchase flight insurance for my American Airlines flight?

Flight insurance can be purchased directly from American Airlines’ website during the flight booking process.

Alternatively, travelers can also purchase travel insurance from third-party providers such as Allianz Global Assistance or other insurance companies.

Travel Insurance Tips: 7 Things to Know Before You Buy

In conclusion, purchasing flight insurance for American Airlines can provide peace of mind and financial protection in case of unexpected events while traveling. The cost of flight insurance varies depending on factors such as the length of the trip, the destination, and the level of coverage chosen by the traveler.

It is important to carefully consider your travel plans and assess the potential risks involved before deciding on whether or not to purchase flight insurance. While it may seem like an unnecessary expense, the benefits of having this type of coverage can far outweigh the cost in the event of an emergency.

By taking the time to research different options and compare prices, travelers can find affordable flight insurance policies that provide the level of protection they need. So next time you plan a trip with American Airlines, consider investing in flight insurance to ensure a worry-free and enjoyable travel experience.