Planning a trip can be exciting, but it can also come with uncertainties. One of the questions that travelers often ask themselves is whether they need travel insurance. If you are planning to fly with American Airlines, you may be wondering if they offer travel insurance to their customers. In this article, we will explore the answer to this question and provide you with all the information you need to make an informed decision about your travel protection.

Contents

- Does American Airlines Offer Travel Insurance?

- Frequently Asked Questions

- What is American Airlines travel insurance?

- What does American Airlines travel insurance cover?

- How much does American Airlines travel insurance cost?

- Is American Airlines travel insurance worth it?

- How do I purchase American Airlines travel insurance?

- Travel Insurance Tips: 7 Things to Know Before You Buy

- How To Print A Boarding Pass For United Airlines?

- Are American Airline Tickets Cheaper At The Airport?

- How To Sign Up For American Airlines Frequent Flyer?

Does American Airlines Offer Travel Insurance?

Traveling can be an exciting experience, but it also comes with its fair share of risks. From lost luggage to flight cancellations, anything can happen while you’re on the move. That’s where travel insurance comes in. It provides coverage for unforeseen events that may occur while you’re traveling. If you’re planning a trip with American Airlines, you may be wondering if they offer travel insurance. In this article, we’ll explore the answer to that question and everything else you need to know about American Airlines travel insurance.

What is American Airlines Travel Insurance?

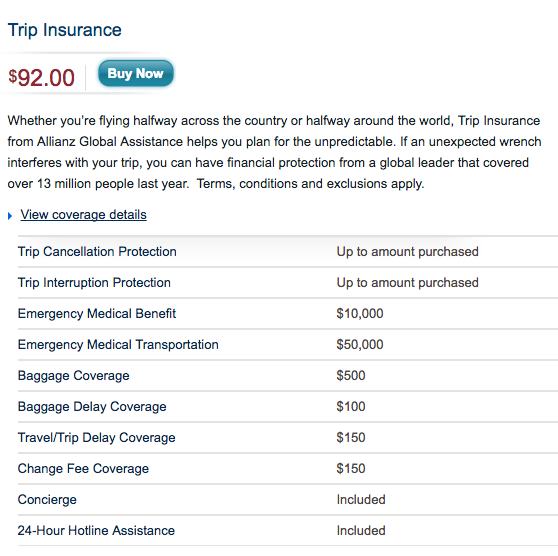

American Airlines offers travel insurance to its customers through its partner, Allianz Global Assistance. This insurance provides coverage for a range of travel-related issues, including trip cancellation, trip interruption, emergency medical expenses, baggage loss, and more. It is available for purchase when you book your flight or at any time before your departure date.

The cost of American Airlines travel insurance varies depending on the type of coverage you choose and the length of your trip. It is important to note that this insurance is optional and not required to purchase a ticket with American Airlines. However, it can provide peace of mind and financial protection in case of unexpected events.

Benefits of American Airlines Travel Insurance

One of the main benefits of American Airlines travel insurance is that it provides coverage for trip cancellation and interruption. This means that if you need to cancel or cut short your trip due to unforeseen circumstances, such as illness or a family emergency, you can receive reimbursement for your non-refundable expenses.

In addition, American Airlines travel insurance provides coverage for emergency medical expenses incurred while traveling. This can include hospitalization, medical treatment, and emergency medical transportation. This coverage can be especially important if you are traveling to a country where medical care is expensive or difficult to access.

Another benefit of American Airlines travel insurance is that it provides coverage for lost or stolen baggage. If your luggage is lost or stolen during your trip, you can receive reimbursement for the value of your belongings. This can provide peace of mind and financial protection if you are traveling with valuable items, such as electronics or jewelry.

Vs Other Travel Insurance Options

While American Airlines travel insurance provides a range of benefits, it is important to compare it to other travel insurance options before making a purchase. One option is to purchase travel insurance through a third-party provider. These providers often offer more comprehensive coverage and lower prices than airline-provided insurance.

Another option is to purchase a credit card that offers travel insurance as a benefit. Many credit cards offer travel insurance as a perk, including coverage for trip cancellation, emergency medical expenses, and lost or stolen baggage. Be sure to read the terms and conditions of your credit card to understand the extent of its travel insurance coverage.

How to Purchase American Airlines Travel Insurance

If you decide to purchase American Airlines travel insurance, you can do so when you book your flight or at any time before your departure date. To purchase insurance, simply visit the American Airlines website and select the “Travel Insurance” option. You will be prompted to enter your travel information and select the type of coverage you want.

It is important to read the terms and conditions of your American Airlines travel insurance policy carefully before making a purchase. Be sure to understand the extent of your coverage and any exclusions or limitations that may apply.

Conclusion

Travel insurance can provide peace of mind and financial protection while you’re on the move. American Airlines offers travel insurance through its partner, Allianz Global Assistance, which provides coverage for a range of travel-related issues. While American Airlines travel insurance provides a range of benefits, it is important to compare it to other travel insurance options before making a purchase.

Whether you decide to purchase travel insurance through American Airlines or another provider, be sure to read the terms and conditions carefully and understand the extent of your coverage. With the right travel insurance in place, you can enjoy your trip with peace of mind and confidence.

Frequently Asked Questions

Here are some common questions about travel insurance with American Airlines.

What is American Airlines travel insurance?

American Airlines offers travel insurance to protect customers against unforeseen circumstances that may arise before or during their trip. The insurance covers a range of incidents, including trip cancellation, trip interruption, and medical emergencies. By purchasing travel insurance, customers can have peace of mind knowing that they are financially protected in case of unexpected events.

It’s important to note that American Airlines travel insurance is provided by Allianz Global Assistance, a reputable insurance provider. Customers can purchase the insurance directly from American Airlines when booking their flight or through Allianz’s website.

What does American Airlines travel insurance cover?

American Airlines travel insurance covers a range of incidents, including trip cancellation, trip interruption, emergency medical and dental expenses, emergency medical transportation, and baggage delay or loss. The insurance also includes 24-hour assistance services for customers who need help during their trip.

It’s important to read the policy carefully before purchasing to understand the coverage and exclusions. Not all incidents may be covered, and there may be limits on the amount of coverage provided for certain incidents.

How much does American Airlines travel insurance cost?

The cost of American Airlines travel insurance varies depending on the length of the trip, the destination, and the level of coverage selected. Generally, the cost ranges from a few dollars to several hundred dollars. Customers can get a quote for travel insurance when booking their flight or by visiting Allianz’s website.

It’s important to weigh the cost of travel insurance against the potential cost of unexpected incidents. In some cases, travel insurance may be a wise investment to protect against financial loss.

Is American Airlines travel insurance worth it?

Whether American Airlines travel insurance is worth it depends on the individual traveler’s needs and circumstances. For some travelers, the peace of mind that comes with knowing they are protected against unexpected incidents is valuable. For others, the cost of travel insurance may outweigh the potential benefits.

It’s important to carefully consider the coverage and exclusions of the policy before purchasing to determine if it meets your needs. Additionally, travelers should consider any existing insurance policies they may have that could provide similar coverage.

How do I purchase American Airlines travel insurance?

Customers can purchase American Airlines travel insurance directly from the airline when booking their flight or by visiting Allianz’s website. To purchase through American Airlines, customers can select the travel insurance option during the booking process. To purchase through Allianz, customers can visit the website and enter their travel details to get a quote and purchase coverage.

It’s important to purchase travel insurance as soon as possible after booking a trip to ensure maximum coverage. Waiting too long could result in some incidents not being covered by the policy.

Travel Insurance Tips: 7 Things to Know Before You Buy

In conclusion, American Airlines does offer travel insurance to its passengers. This insurance covers a range of unforeseen circumstances, such as trip cancellations, delays, lost or stolen baggage, and medical emergencies. By purchasing travel insurance, passengers can have peace of mind and protection against unexpected events that may impact their travel plans.

It is important to note that while American Airlines does offer travel insurance, it is not mandatory for passengers to purchase it. However, it is highly recommended, especially for those who are traveling internationally or have expensive travel arrangements. With travel insurance, passengers can avoid costly out-of-pocket expenses that may arise due to unforeseen events.

Overall, American Airlines provides a comprehensive travel insurance policy that can benefit all types of travelers. Whether you are traveling for business or pleasure, it is always a good idea to consider purchasing travel insurance for added protection and peace of mind.