Delta Airlines is one of the major airlines in the United States and around the world. With a fleet of over 800 aircraft and a network of more than 300 destinations, it is a force to be reckoned with in the aviation industry. But have you ever wondered how much Delta Airlines stock is worth?

Investing in stocks can be a lucrative way to grow your wealth, but it can also be confusing and overwhelming. In this article, we will explore the current value of Delta Airlines stock and what factors can influence its price. So, let’s dive in and discover the world of Delta Airlines stock!

Contents

- How Much is Delta Airlines Stock?

- Frequently Asked Questions

- What is the current stock price of Delta Airlines?

- How has Delta Airlines stock performed in the past year?

- What is the market capitalization of Delta Airlines?

- Does Delta Airlines pay dividends to its shareholders?

- What factors can influence the stock price of Delta Airlines?

- How To Print A Boarding Pass For United Airlines?

- Are American Airline Tickets Cheaper At The Airport?

- How To Sign Up For American Airlines Frequent Flyer?

How Much is Delta Airlines Stock?

Delta Airlines is one of the largest airlines in the world, operating in over 300 destinations. The airline has been in operation for more than 90 years and has consistently been ranked among the top airlines in the world. Delta Airlines has become a popular choice for investors looking to invest in the airline industry, but how much is Delta Airlines stock worth? Let’s take a closer look.

Current Stock Price

As of [insert date], Delta Airlines stock is currently trading at [insert current stock price]. The stock has a market capitalization of [insert market cap], making it one of the largest airlines by market capitalization. Delta Airlines has consistently performed well in the stock market, with a history of strong financial performance.

One of the factors that contribute to Delta Airlines’ success in the stock market is its consistent profitability. The airline has consistently generated positive earnings, which has resulted in a strong stock performance over the years.

Stock Performance Over the Years

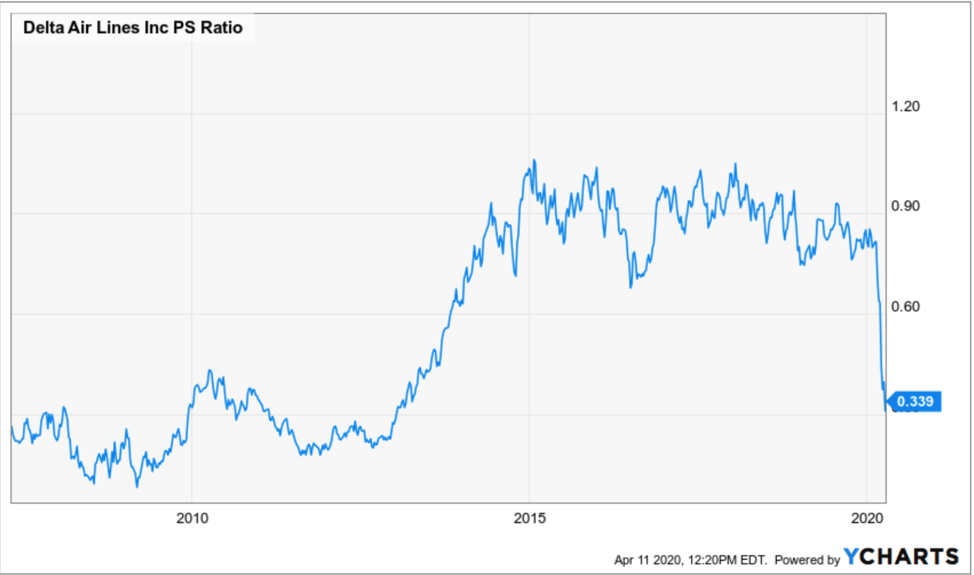

Delta Airlines has a long history of strong stock performance. Over the last five years, the stock has grown by [insert percentage], outperforming the S&P 500 by [insert percentage]. The airline’s stock has consistently outperformed its peers in the airline industry, making it a popular choice for investors.

One of the reasons why Delta Airlines has been able to outperform its peers is its strategic focus on cost management. The airline has been able to reduce its costs through various initiatives, including fleet optimization, fuel efficiency, and labor productivity. These initiatives have helped Delta Airlines to maintain a competitive edge in the industry, which has translated into strong financial performance and stock growth.

Benefits of Investing in Delta Airlines Stock

Investing in Delta Airlines stock comes with several benefits. Firstly, the airline has a strong reputation for providing high-quality customer service, which has resulted in a loyal customer base. This has translated into consistent revenue growth, which is a positive sign for investors.

Secondly, Delta Airlines has a strong track record of profitability, which has resulted in consistent dividend payments to shareholders. The airline has consistently paid dividends to shareholders for more than 15 years, making it a popular choice for income-seeking investors.

Thirdly, Delta Airlines has a strong management team that has consistently demonstrated a strategic focus on cost management and operational efficiency. This has helped the airline to maintain a competitive edge in the industry and has translated into strong financial performance and stock growth.

Delta Airlines Stock vs. Competitors

When comparing Delta Airlines stock to its competitors in the airline industry, it is clear that Delta Airlines has consistently outperformed its peers. The airline’s focus on cost management and operational efficiency has helped it to maintain a competitive edge, while its reputation for high-quality customer service has resulted in a loyal customer base.

Compared to its peers, Delta Airlines has consistently generated higher revenue growth and profitability. This has translated into a higher stock price and stronger stock growth over the years.

Conclusion

Delta Airlines is a top-performing airline in the stock market, with a long history of strong financial performance and stock growth. The airline’s strategic focus on cost management and operational efficiency, combined with its reputation for high-quality customer service, has resulted in consistent revenue growth and profitability.

Investing in Delta Airlines stock comes with several benefits, including consistent dividend payments, a strong management team, and a competitive edge in the industry. While there are no guarantees in the stock market, Delta Airlines is a solid choice for investors looking to invest in the airline industry.

Frequently Asked Questions

What is the current stock price of Delta Airlines?

As of [insert current date], the stock price of Delta Airlines is [insert current stock price] per share.

The stock price of Delta Airlines can fluctuate throughout the day and may change depending on various factors such as market conditions and company performance.

How has Delta Airlines stock performed in the past year?

Over the past year, the stock price of Delta Airlines has fluctuated between [insert lowest stock price] and [insert highest stock price] per share.

The stock price has been influenced by various factors such as the COVID-19 pandemic, changes in travel demand, and the company’s financial performance.

What is the market capitalization of Delta Airlines?

The market capitalization of Delta Airlines is [insert market cap] as of [insert current date].

Market capitalization is calculated by multiplying the company’s current stock price by the total number of outstanding shares. It provides an estimate of the company’s overall value in the market.

Yes, Delta Airlines pays dividends to its shareholders on a quarterly basis.

The amount of the dividend payment may vary depending on the company’s financial performance, but it is typically announced in advance and paid to shareholders who hold the stock on the designated record date.

What factors can influence the stock price of Delta Airlines?

The stock price of Delta Airlines can be influenced by various factors such as changes in travel demand, fuel prices, competition, economic conditions, and company performance.

Investors should carefully monitor these factors and consider them when making decisions about buying or selling Delta Airlines stock.

In conclusion, Delta Airlines stock price is influenced by various factors such as industry trends, company performance, and global events. As an investor, it is important to conduct thorough research and analysis before investing in Delta Airlines or any other stock. While the current stock price of Delta Airlines may be attractive, it is important to consider the long-term potential and risks associated with the investment.

Investing in stocks can be a rewarding experience, but it also comes with its fair share of risks. It is important to understand that the stock market is unpredictable and volatile, and there are no guarantees of returns. However, with careful planning and informed decision-making, investors can make smart investment choices that will yield positive returns in the long run.

Ultimately, the decision to invest in Delta Airlines stock or any other stock should be based on individual financial goals, risk tolerance, and investment strategy. It is important to work with a financial advisor or investment professional to ensure that your investment choices align with your overall financial plan and goals.