Are you planning to book a trip with American Airlines? Then, you might be wondering if you need trip insurance. Trip insurance can provide you with peace of mind and protect you from unexpected events that can occur during your travels. In this article, we will explore the benefits of trip insurance and help you decide if it’s right for you. So, sit back, relax, and let’s dive in!

Contents

- Do I Need Trip Insurance American Airlines?

- Frequently Asked Questions

- What is Trip Insurance for American Airlines?

- What Does American Airlines Trip Insurance Cover?

- Do I Really Need Trip Insurance for American Airlines?

- How Much Does American Airlines Trip Insurance Cost?

- How Do I Purchase Trip Insurance for American Airlines?

- Do I Really Need Travel Insurance?

- How To Print A Boarding Pass For United Airlines?

- Are American Airline Tickets Cheaper At The Airport?

- How To Sign Up For American Airlines Frequent Flyer?

Do I Need Trip Insurance American Airlines?

Traveling is an exciting experience, but sometimes unforeseen circumstances can disrupt our plans. For this reason, many travelers wonder if they need trip insurance for their American Airlines flights. In this article, we’ll explore the benefits of trip insurance and help you decide if it’s worth investing in for your next trip.

What is Trip Insurance?

Trip insurance, also known as travel insurance, is a type of insurance that provides coverage for unexpected events that may occur while traveling. This can include trip cancellation or interruption, flight delays or cancellations, medical emergencies, lost or stolen luggage, and more. Depending on the policy, trip insurance may cover the cost of travel arrangements, medical expenses, and other related expenses.

When booking a flight with American Airlines, you may have the option to purchase trip insurance through their partner, Allianz Global Assistance. Trip insurance can also be purchased through third-party insurance providers.

Benefits of Trip Insurance

One of the main benefits of trip insurance is the peace of mind it provides. Traveling can be unpredictable, and having trip insurance can help you feel more secure in case something unexpected happens. Here are some other benefits of trip insurance:

- Protection against trip cancellation or interruption

- Coverage for medical emergencies

- Reimbursement for lost or stolen luggage

- 24/7 travel assistance

Do I Need Trip Insurance?

Whether or not you need trip insurance depends on your personal circumstances and travel plans. Here are some factors to consider when deciding if trip insurance is necessary:

Cost of the Trip

If you’re taking an expensive trip, it may be worth investing in trip insurance to protect your investment. Trip insurance can provide reimbursement for non-refundable expenses in case you need to cancel or interrupt your trip.

Health and Medical History

If you have pre-existing medical conditions or are traveling to a destination with limited medical facilities, trip insurance may be a good idea. It can provide coverage for medical emergencies and evacuation if necessary.

Potential for Travel Disruptions

If you’re traveling during a busy time of year, such as holidays or peak travel season, there may be a higher risk of flight delays or cancellations. Trip insurance can provide coverage for these types of travel disruptions.

Level of Risk Tolerance

Ultimately, the decision to purchase trip insurance comes down to your level of risk tolerance. If you’re comfortable taking on the financial risk of unexpected travel expenses, you may not need trip insurance. However, if you prefer to have the peace of mind that comes with having coverage, trip insurance may be a wise investment.

Trip Insurance vs. American Airlines Travel Protection

American Airlines offers its own travel protection plan, which provides coverage for trip cancellation, trip interruption, and trip delay. However, this plan does not provide coverage for medical emergencies, lost or stolen luggage, or other travel-related expenses.

If you’re looking for more comprehensive coverage, purchasing trip insurance through a third-party provider may be a better option.

In Conclusion

Whether or not you need trip insurance for your American Airlines flight depends on your personal circumstances and travel plans. However, trip insurance can provide peace of mind and protection against unexpected travel expenses. Be sure to carefully consider your options and choose the plan that best fits your needs.

Frequently Asked Questions

What is Trip Insurance for American Airlines?

Trip insurance for American Airlines is an insurance policy that provides coverage for unexpected events that may occur before or during your trip. It can provide financial protection for things like trip cancellations, medical emergencies, and baggage loss or delay.

When you purchase trip insurance for American Airlines, you are essentially buying peace of mind. It can help you feel more secure knowing that you have coverage in case something unexpected happens.

What Does American Airlines Trip Insurance Cover?

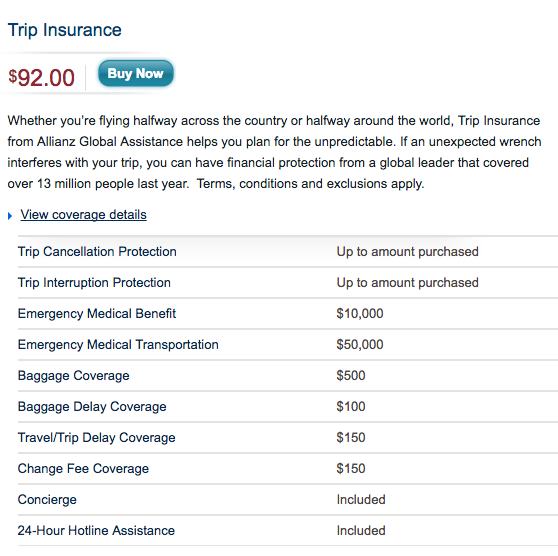

The coverage provided by American Airlines trip insurance can vary depending on the specific policy you choose. However, most policies will provide coverage for things like trip cancellation or interruption, medical emergencies, and baggage loss or delay.

Trip cancellation or interruption coverage can provide reimbursement for prepaid expenses if your trip is canceled or interrupted due to a covered reason, such as illness or bad weather. Medical emergency coverage can provide reimbursement for medical expenses incurred during your trip, while baggage coverage can provide reimbursement for lost, stolen, or delayed baggage.

Do I Really Need Trip Insurance for American Airlines?

Whether or not you need trip insurance for American Airlines depends on your individual circumstances. If you are traveling on a tight budget and cannot afford to lose any money due to unexpected events, trip insurance can be a good investment.

Likewise, if you are traveling to a remote or medically unstable area, medical emergency coverage can be particularly important. Ultimately, the decision to purchase trip insurance for American Airlines should be based on your individual needs and comfort level.

How Much Does American Airlines Trip Insurance Cost?

The cost of American Airlines trip insurance can vary depending on a number of factors, including the length of your trip, your age and health, and the level of coverage you choose. Generally speaking, trip insurance can cost anywhere from a few dollars to several hundred dollars.

To get an accurate quote for American Airlines trip insurance, you can visit the airline’s website or speak to a customer service representative. Remember to compare policies from different providers to ensure you are getting the best value for your money.

How Do I Purchase Trip Insurance for American Airlines?

To purchase trip insurance for American Airlines, you can visit the airline’s website or speak to a customer service representative. You will typically be asked to provide information about your trip, such as the dates of travel and the total cost of your trip.

Once you have provided this information, you will be presented with a range of insurance options to choose from. Be sure to read the policy details carefully and ask any questions you may have before making a decision.

Do I Really Need Travel Insurance?

In conclusion, deciding whether or not to purchase trip insurance for your American Airlines flight can be a difficult decision. However, it’s important to remember that unexpected events can happen at any time, and having trip insurance can provide peace of mind and financial protection.

When considering purchasing trip insurance, it’s important to take into account factors such as the cost of your trip, your personal circumstances, and the potential risks involved. Additionally, be sure to carefully review the terms and conditions of the policy to ensure that it covers any potential issues that may arise.

Ultimately, the decision to purchase trip insurance for your American Airlines flight is a personal one, but it’s always better to be safe than sorry. By taking the time to carefully consider your options and make an informed decision, you can enjoy your trip with the knowledge that you’re protected in case of any unforeseen circumstances.