Delta Airlines is one of the largest airlines in the world, with a reputation for excellence in customer service and reliability. But is it a good stock to buy? With the aviation industry facing unprecedented challenges in the wake of the COVID-19 pandemic, investors are understandably cautious about investing in airlines. However, Delta Airlines has taken proactive measures to address the impact of the pandemic, and there are reasons to believe that it may be a good investment opportunity for those willing to take a calculated risk. In this article, we will explore the factors that make Delta Airlines a potentially good stock to buy and the risks associated with investing in the airline industry.

Contents

- Is Delta Airlines a Good Stock to Buy?

- Frequently Asked Questions

- What are the factors to consider before investing in Delta Airlines?

- What are the benefits of investing in Delta Airlines?

- What are the risks of investing in Delta Airlines?

- What is the current state of Delta Airlines’ financial health?

- What is the long-term outlook for Delta Airlines?

- How To Print A Boarding Pass For United Airlines?

- Are American Airline Tickets Cheaper At The Airport?

- How To Sign Up For American Airlines Frequent Flyer?

Is Delta Airlines a Good Stock to Buy?

Delta Airlines, one of the major airlines in the United States, has been a popular choice for investors looking to invest in the airline industry. However, with the recent pandemic, the airline industry has been hit hard, and investors are left wondering whether Delta Airlines is still a good stock to buy. In this article, we will explore Delta Airlines’ performance, financial stability, and future prospects to determine whether it is a good investment.

Financial Performance

Delta Airlines has been a consistent performer in terms of its financial performance. In 2019, the company reported a revenue of $47 billion, with a net income of $4.8 billion. However, the pandemic has hit the airline industry hard, and Delta Airlines reported a net loss of $12.4 billion in 2020.

Despite the losses, Delta Airlines has taken steps to strengthen its financial position. The company has reduced its debt by $16 billion and raised $16.5 billion in liquidity. This has helped the company navigate the pandemic and position itself for growth in the future.

Market Position

Delta Airlines is one of the leading airlines in the United States, with a market share of approximately 17%. The company operates more than 5,000 flights daily and serves over 300 destinations in 50 countries. Delta Airlines has also been recognized for its customer service, ranking first among the major airlines in the J.D. Power North America Airline Satisfaction Study.

However, the pandemic has had a significant impact on the airline industry, and Delta Airlines has had to make adjustments to its operations. The company has reduced its capacity and suspended flights to certain destinations. It remains to be seen how long it will take for the airline industry to recover fully.

Future Prospects

Despite the challenges posed by the pandemic, Delta Airlines has a positive outlook for the future. The company has a strong brand, a loyal customer base, and a robust network of destinations. In addition, the demand for air travel is expected to increase as restrictions are lifted and people begin to travel again.

Delta Airlines has also taken steps to adapt to the changing environment. The company has introduced new cleaning protocols and safety measures to ensure the safety of its passengers. The company has also invested in technology to improve the customer experience and streamline operations.

Benefits of Investing in Delta Airlines

Investing in Delta Airlines can provide several benefits. The company has a strong market position, a loyal customer base, and a robust network of destinations. In addition, the company has taken steps to strengthen its financial position, reducing its debt and increasing liquidity.

Delta Airlines also has a positive outlook for the future. As the demand for air travel increases, the company is well-positioned to benefit from this trend. Investing in Delta Airlines can provide exposure to the airline industry and the potential for long-term growth.

Delta Airlines vs. Competitors

When compared to its competitors, Delta Airlines has several advantages. The company has a strong brand and a loyal customer base, which gives it a competitive advantage in the market. In addition, Delta Airlines has a robust network of destinations, which provides it with a significant market share.

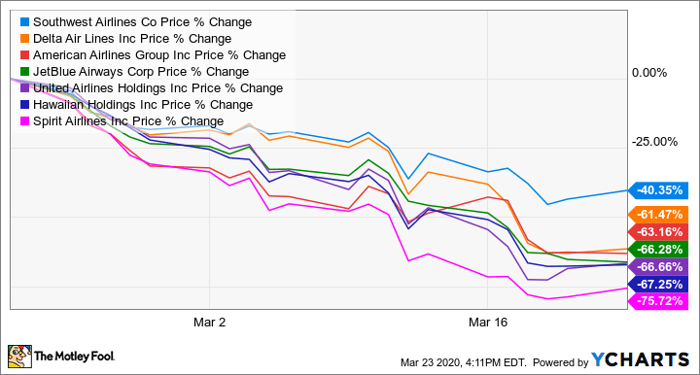

However, the pandemic has impacted the airline industry as a whole, and all airlines have had to make adjustments to their operations. It remains to be seen how long it will take for the industry to recover fully, and how this will impact Delta Airlines’ position in the market.

Conclusion

Delta Airlines has been a consistent performer in the airline industry, with a strong market position and a loyal customer base. Despite the challenges posed by the pandemic, the company has taken steps to strengthen its financial position and position itself for growth in the future.

Investing in Delta Airlines can provide exposure to the airline industry and the potential for long-term growth. However, it is important to consider the impact of the pandemic on the industry as a whole and how this may impact Delta Airlines’ performance in the future. As with any investment, it is important to conduct thorough research and consult with a financial advisor before making any investment decisions.

Frequently Asked Questions

What are the factors to consider before investing in Delta Airlines?

Before investing in any stock, it’s essential to consider various factors. In the case of Delta Airlines, one should look at the company’s financial health, growth potential, and competitive landscape. Additionally, it’s crucial to analyze the airline industry’s current state and prospects in the long run.

Furthermore, investors should consider Delta Airlines’ management team, their strategies for future growth, and their track record of delivering shareholder value. By evaluating these factors, investors can make an informed decision about whether Delta Airlines is a good stock to buy.

What are the benefits of investing in Delta Airlines?

Investing in Delta Airlines can offer numerous benefits for investors. First, the company has a strong brand reputation and is one of the largest airlines in the world. This means that it has considerable market share and customer loyalty, which can translate into stable revenue streams.

In addition, Delta Airlines has a history of delivering solid financial performance and consistent earnings growth. The company’s management team has implemented cost-cutting measures and operational efficiencies to improve profitability. Lastly, Delta Airlines pays a dividend to its shareholders, which can provide a steady income stream.

What are the risks of investing in Delta Airlines?

Like any investment, there are risks associated with investing in Delta Airlines. One of the most significant risks is the airline industry’s volatility, which can be affected by factors such as fuel prices, economic downturns, and geopolitical events.

In addition, Delta Airlines faces competition from other airlines, which can impact its market share and profitability. Moreover, the company’s operations are subject to various risks, such as natural disasters, technology failures, and labor disputes.

What is the current state of Delta Airlines’ financial health?

Delta Airlines has a strong financial position, with a market capitalization of over $20 billion. The company has consistently delivered positive earnings growth and has a stable revenue stream due to its brand recognition and loyal customer base.

Furthermore, Delta Airlines has a healthy balance sheet, with manageable debt levels and a solid cash position. The company has also implemented cost-cutting measures and operational efficiencies to improve profitability, which has resulted in strong free cash flow generation.

What is the long-term outlook for Delta Airlines?

The long-term outlook for Delta Airlines is positive, given the company’s strong brand recognition and market position. The airline industry is expected to grow in the coming years, which will provide opportunities for Delta Airlines to expand its operations and increase its revenue streams.

In addition, Delta Airlines has a solid management team that has implemented growth strategies, such as expanding into new markets and investing in technology. The company is also committed to reducing its carbon footprint, which can help it attract environmentally conscious customers and investors.

In conclusion, Delta Airlines seems to be a promising stock to buy. The company has a strong track record of profitability in the aviation industry, and it has demonstrated resilience through difficult market conditions. Additionally, Delta has made strategic investments in technology and customer service to enhance its competitive edge.

However, as with any investment, there are risks associated with buying Delta’s stock. The aviation industry is highly cyclical and sensitive to economic conditions, and unforeseen events such as natural disasters or political instability can have a significant impact on Delta’s business. Furthermore, there is always a chance that Delta may face increased competition or operational challenges that could negatively impact its financial performance.

Overall, investors who are willing to take on some risk may find that Delta Airlines represents a good investment opportunity. However, it is important to carefully consider the potential risks and to conduct thorough research before making any investment decisions.