Booking a flight can be a nerve-wracking experience, especially when you consider the potential risks involved. From delayed flights to lost luggage, unforeseen events can quickly turn your dream vacation into a nightmare. That’s where flight insurance comes in, and American Airlines is one of the major carriers that offer this option to its passengers. But is it worth the extra cost? In this article, we’ll take a closer look at the benefits and drawbacks of purchasing flight insurance with American Airlines, so you can make an informed decision before your next trip.

Contents

- Is Flight Insurance Worth It American Airlines?

- Frequently Asked Questions

- What is Flight Insurance?

- Why Should I Consider Purchasing Flight Insurance?

- What Does American Airlines’ Flight Insurance Cover?

- How Do I Know if Flight Insurance is Worth the Cost?

- Can I Purchase Flight Insurance After Booking my American Airlines Flight?

- Should you buy travel insurance for your plane ticket?

- How To Print A Boarding Pass For United Airlines?

- Are American Airline Tickets Cheaper At The Airport?

- How To Sign Up For American Airlines Frequent Flyer?

Is Flight Insurance Worth It American Airlines?

When it comes to traveling, especially by air, many unexpected events can happen. From delayed flights to lost luggage, the possibilities can be daunting. One way to protect your investment and peace of mind is through flight insurance. But, is flight insurance worth it American Airlines? Here’s what you need to know.

The Basics of Flight Insurance

Flight insurance is a type of travel insurance that can provide coverage for a variety of issues that can arise in the course of your journey. Depending on the policy, it can include coverage for trip cancellation, trip interruption, trip delay, baggage loss or damage, and even emergency medical expenses.

It’s important to note that American Airlines does not require passengers to purchase flight insurance. However, it’s always a good idea to consider purchasing it as it can provide a safety net in case something goes wrong during your travels.

Benefits of Flight Insurance

One of the main benefits of flight insurance is that it can provide peace of mind. When you purchase a policy, you know that you have a safety net in case something goes wrong. If your flight is delayed or canceled, you can be reimbursed for the cost of your ticket. If your luggage is lost or damaged, you can be reimbursed for the cost of your belongings.

Another benefit of flight insurance is that it can provide coverage for emergency medical expenses. If you become ill or injured during your trip, your insurance policy can help cover the cost of medical care. This can be especially important if you are traveling outside of your home country and are unfamiliar with the local healthcare system.

What to Consider When Purchasing Flight Insurance

When purchasing flight insurance, it’s important to consider a few key factors. First, you’ll want to think about the type of coverage you need. Do you need coverage for trip cancellation or trip interruption? Do you need coverage for lost or damaged baggage? You’ll also want to consider the policy limits and any exclusions that may apply.

Another factor to consider is the cost of the insurance. While flight insurance can be a wise investment, it’s important to make sure that you’re not overpaying for coverage. Be sure to compare policies and prices to find the best option for your needs and budget.

Is Flight Insurance worth It?

Ultimately, whether or not flight insurance is worth it depends on your individual needs and circumstances. If you’re someone who travels frequently and wants peace of mind, then flight insurance can be a great investment. However, if you’re someone who rarely travels or is comfortable with taking on some risk, then flight insurance may not be necessary.

When it comes to American Airlines, the airline does not require passengers to purchase flight insurance. However, it’s always a good idea to consider purchasing it on your own to protect your investment and peace of mind.

Conclusion

Whether or not to purchase flight insurance is a personal decision that depends on your individual needs and circumstances. If you’re someone who wants peace of mind and protection for unexpected events, then flight insurance can be a wise investment. American Airlines does not require passengers to purchase flight insurance, but it’s always a good idea to consider it on your own.

Remember to consider the type of coverage you need, policy limits, and the cost of the insurance when making your decision. By taking the time to carefully consider your options, you can make the best decision for your needs and budget.

Frequently Asked Questions

What is Flight Insurance?

Flight Insurance is a type of insurance that provides coverage for unexpected events that may occur during your flight, including flight cancellations, delays, or lost baggage. It can also provide coverage for medical emergencies that may happen during your trip.

Flight insurance policies vary depending on the provider, but most policies will provide coverage for trip cancellations, trip interruptions, and flight delays or cancellations. Some policies may also provide coverage for lost or stolen baggage, medical expenses, and emergency medical evacuation.

Why Should I Consider Purchasing Flight Insurance?

Purchasing flight insurance can provide peace of mind and financial protection in case of unexpected events during your trip. If your flight is cancelled or delayed, you may be able to recoup some or all of your expenses through your flight insurance policy.

Additionally, if you become ill or injured during your trip, your flight insurance policy may cover your medical expenses and emergency medical evacuation. This can be especially important if you are traveling to a foreign country where medical costs can be very high.

What Does American Airlines’ Flight Insurance Cover?

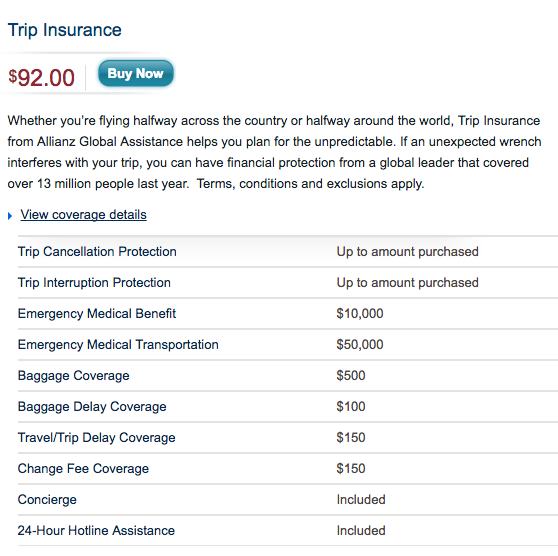

American Airlines’ Flight Insurance covers trip cancellations, trip interruptions, and flight delays or cancellations. It also provides coverage for lost or stolen baggage, medical expenses, and emergency medical evacuation.

The cost of American Airlines’ Flight Insurance varies depending on the length of your trip and the level of coverage you choose. You can purchase flight insurance when you book your flight on the American Airlines website or through a travel agent.

How Do I Know if Flight Insurance is Worth the Cost?

Whether or not flight insurance is worth the cost depends on your individual travel plans and risk tolerance. If you are traveling internationally or have a long and expensive trip planned, flight insurance may be a good investment to protect your investment.

However, if you are taking a short and relatively inexpensive trip, the cost of flight insurance may not be worth the potential benefits. It is important to carefully consider your travel plans and weigh the cost of flight insurance against the potential benefits before making a decision.

Can I Purchase Flight Insurance After Booking my American Airlines Flight?

Yes, you can purchase flight insurance after booking your American Airlines flight. You can purchase flight insurance through the American Airlines website or through a travel agent.

It is important to note that if you purchase flight insurance after booking your flight, you may not be covered for events that occur before the policy goes into effect. Be sure to read the policy carefully and understand the coverage limitations before purchasing flight insurance.

Should you buy travel insurance for your plane ticket?

In conclusion, whether or not flight insurance is worth it for American Airlines ultimately depends on your individual circumstances and preferences. If you are someone who frequently travels and wants peace of mind in case of unexpected cancellations or delays, then investing in flight insurance may be a good option for you. On the other hand, if you are a more infrequent traveler and are comfortable taking on the risk of potential flight disruptions, then skipping the insurance may be a better choice.

It is also important to note that American Airlines offers several different types of flight insurance, each with its own set of benefits and costs. Be sure to carefully review the details of each policy before making a decision, and consider working with a travel agent or insurance professional if you need additional guidance.

Ultimately, the decision to purchase flight insurance for American Airlines is a personal one that requires careful consideration of your travel habits, budget, and risk tolerance. By weighing the pros and cons of different policies and considering your unique needs, you can make an informed choice about whether or not to invest in flight insurance for your next trip.