Traveling can be an exciting adventure, but it’s important to be prepared for the unexpected. One way to protect yourself on your next trip with American Airlines is to consider purchasing trip insurance. But is it really worth it? In this article, we’ll explore the benefits and drawbacks of trip insurance for American Airlines travelers, helping you make an informed decision before your next journey.

**H2: Is Trip Insurance Worth It American Airlines?**

Are you planning a trip with American Airlines and considering whether to purchase travel insurance? With the unexpected events that can occur during travel, it’s important to weigh the benefits of trip insurance against the cost. In this article, we’ll explore the advantages and disadvantages of purchasing trip insurance with American Airlines.

**H3: What is Trip Insurance?**

Trip insurance is a type of travel insurance that covers unexpected events that could happen during your travels. This could include trip cancellations, flight delays, lost or stolen luggage, medical emergencies, and more. Trip insurance is designed to provide peace of mind and financial protection should something go wrong during your trip.

When you purchase trip insurance, you typically pay a premium based on the cost of your trip and the level of coverage you select. This premium covers the cost of the insurance policy and ensures that you will be reimbursed for covered expenses should they occur.

**H3: American Airlines Trip Insurance**

American Airlines offers travel insurance through its partner, Allianz Global Assistance. The insurance policy covers a range of events, including trip cancellations, trip interruptions, travel delays, baggage delays, lost or stolen baggage, and emergency medical and dental coverage.

The cost of American Airlines trip insurance varies based on the cost of your trip and the level of coverage you select. You can purchase trip insurance at the time of booking your flight or up until 24 hours before departure.

**H3: Benefits of American Airlines Trip Insurance**

One of the biggest benefits of purchasing trip insurance with American Airlines is the peace of mind it provides. With trip insurance, you can feel confident that you will be covered in the event of unexpected events, such as trip cancellations or medical emergencies. American Airlines trip insurance also provides coverage for lost or stolen luggage, which can be a significant expense if it happens during your travels.

Another benefit to American Airlines trip insurance is the flexibility it provides. If you need to cancel your trip for a covered reason, you can receive reimbursement for the cost of your trip. Additionally, if your flight is delayed or cancelled, you may be eligible for reimbursement for additional expenses, such as hotel accommodations and meals.

**H3: Drawbacks of American Airlines Trip Insurance**

One of the drawbacks of American Airlines trip insurance is the cost. Depending on the level of coverage you select and the cost of your trip, the premium for trip insurance can be quite high. Additionally, some travelers may feel that the coverage provided by American Airlines trip insurance is not sufficient for their needs.

Another potential drawback of American Airlines trip insurance is the exclusions and limitations of coverage. It’s important to carefully review the policy to understand what is covered and what is not. For example, pre-existing medical conditions may not be covered by the policy.

**H3: Trip Insurance vs. Credit Card Coverage**

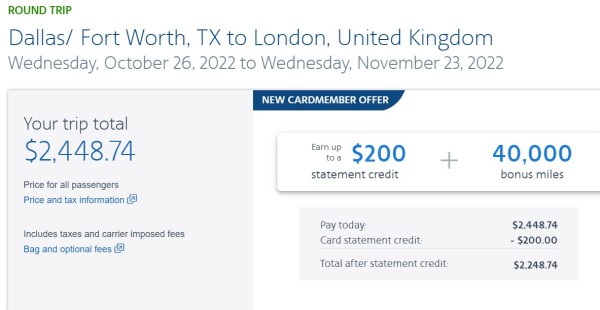

If you have a credit card that offers travel benefits, you may already have some coverage for unexpected events during your travels. Many credit cards offer trip cancellation and interruption coverage, as well as rental car insurance and baggage coverage.

However, it’s important to understand the limitations of credit card coverage. Coverage may be limited to certain events, and the coverage amounts may be lower than what you would receive with a dedicated trip insurance policy. Additionally, some credit card coverage may require you to pay for your trip with the card in order to qualify for coverage.

**H3: Conclusion**

When considering whether to purchase trip insurance with American Airlines, it’s important to weigh the benefits against the cost. While trip insurance can provide peace of mind and financial protection, it may not be necessary for all travelers. If you already have travel benefits through a credit card, you may not need additional coverage.

However, if you are concerned about unexpected events during your travels, American Airlines trip insurance may be a good investment. Just be sure to carefully review the policy to understand the coverage and limitations before making a purchase.

Contents

- Frequently Asked Questions

- What is trip insurance and what does it cover?

- How much does trip insurance with American Airlines cost?

- What are some situations where trip insurance with American Airlines may be useful?

- What are some limitations or exclusions of trip insurance with American Airlines?

- Is trip insurance with American Airlines worth it?

- Travel Insurance Tips: 7 Things to Know Before You Buy

- How To Print A Boarding Pass For United Airlines?

- Are American Airline Tickets Cheaper At The Airport?

- How To Sign Up For American Airlines Frequent Flyer?

Frequently Asked Questions

Here are some commonly asked questions about trip insurance with American Airlines:

What is trip insurance and what does it cover?

Trip insurance is a type of coverage that can protect you financially if unexpected events interfere with your travel plans. Some common types of coverage include trip cancellation/interruption, emergency medical and dental, baggage loss/delay, and travel delay. The specific coverage and benefits can vary depending on the policy you choose.

It is important to carefully review the policy details before purchasing to ensure that it meets your needs and provides adequate coverage.

How much does trip insurance with American Airlines cost?

The cost of trip insurance with American Airlines can vary depending on the type of coverage you choose, your travel plans, and other factors. Generally, the cost can range from a few dollars up to 10% or more of the total cost of your trip. It is important to compare different policies and providers to find the best coverage at a price that fits your budget.

Keep in mind that the cost of trip insurance may be worth it if it can provide peace of mind and protect you financially in case of unexpected events.

What are some situations where trip insurance with American Airlines may be useful?

There are many situations where trip insurance with American Airlines may be useful. For example, if you have a medical emergency and are unable to travel, trip cancellation/interruption coverage can help you recover some or all of your non-refundable expenses. Similarly, if your baggage is lost or delayed, baggage loss/delay coverage can help reimburse you for necessary purchases.

Other situations where trip insurance may be useful include travel delays, natural disasters, and unexpected job loss or military deployment.

What are some limitations or exclusions of trip insurance with American Airlines?

It is important to carefully review the policy details before purchasing trip insurance with American Airlines or any other provider. Some common limitations or exclusions may include pre-existing medical conditions, acts of terrorism, and extreme sports or activities.

Additionally, some policies may have specific requirements or restrictions, such as a minimum trip length or a maximum age limit. Make sure to read the policy carefully and ask any questions before purchasing to avoid any surprises or confusion.

Is trip insurance with American Airlines worth it?

Whether or not trip insurance with American Airlines is worth it depends on a variety of factors, including your travel plans, budget, and risk tolerance. If you have a complex itinerary, are traveling internationally, or have non-refundable expenses, trip insurance may be a good investment to protect yourself financially in case of unexpected events.

On the other hand, if you have a simple itinerary and are willing to take on some risk, you may decide that trip insurance is not necessary. Ultimately, the decision of whether or not to purchase trip insurance is a personal one that depends on your individual circumstances and preferences.

Travel Insurance Tips: 7 Things to Know Before You Buy

In conclusion, trip insurance can be a valuable investment when booking with American Airlines. While it may cost extra, it provides peace of mind and protection against unforeseen events that could otherwise ruin your trip. Whether it’s a medical emergency, flight cancellation, or lost baggage, having trip insurance can help minimize the financial impact and stress of these situations.

It’s important to carefully consider the coverage options and limitations of any trip insurance plan before making a purchase. Some plans may exclude certain circumstances or have higher deductibles, so be sure to read the fine print and choose a plan that best fits your needs.

Overall, trip insurance is a personal choice and depends on individual circumstances. If you’re taking a once-in-a-lifetime trip or have non-refundable bookings, it may be worth investing in trip insurance. However, if you have flexible travel plans and can afford to absorb the financial risk of unforeseen events, you may choose to skip trip insurance. Ultimately, the decision is yours to make, but it’s always better to be safe than sorry.